Given the importance of MDM scheme in providing nutrition, and helping increase enrolment and hence education of students, data/information about the scheme should be readily available and accessible to the common masses. Figure 9 lists essential data points/information regarding MDM that will be useful to various stakeholders. The current level of information available has been evaluated for these indicators.

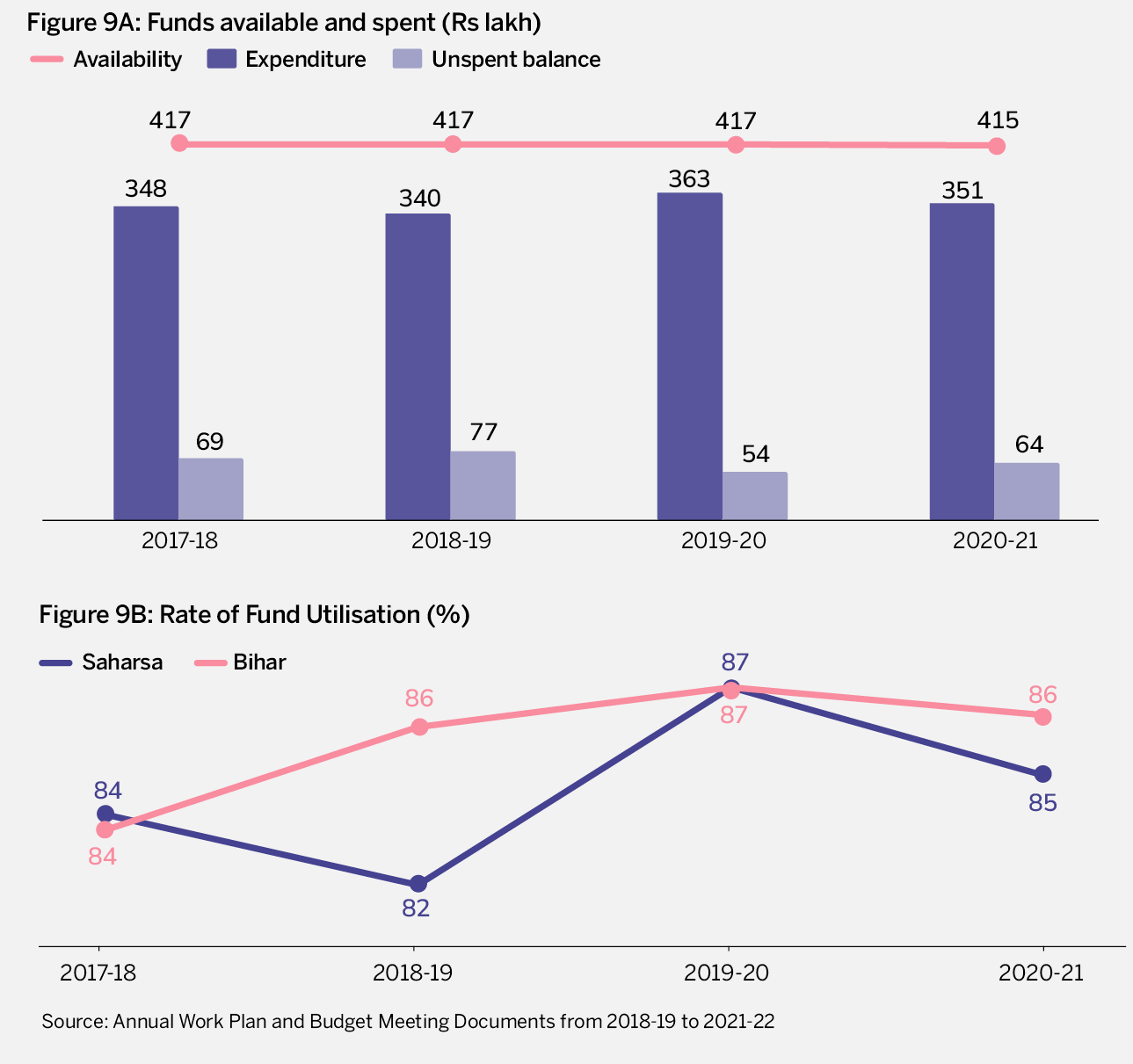

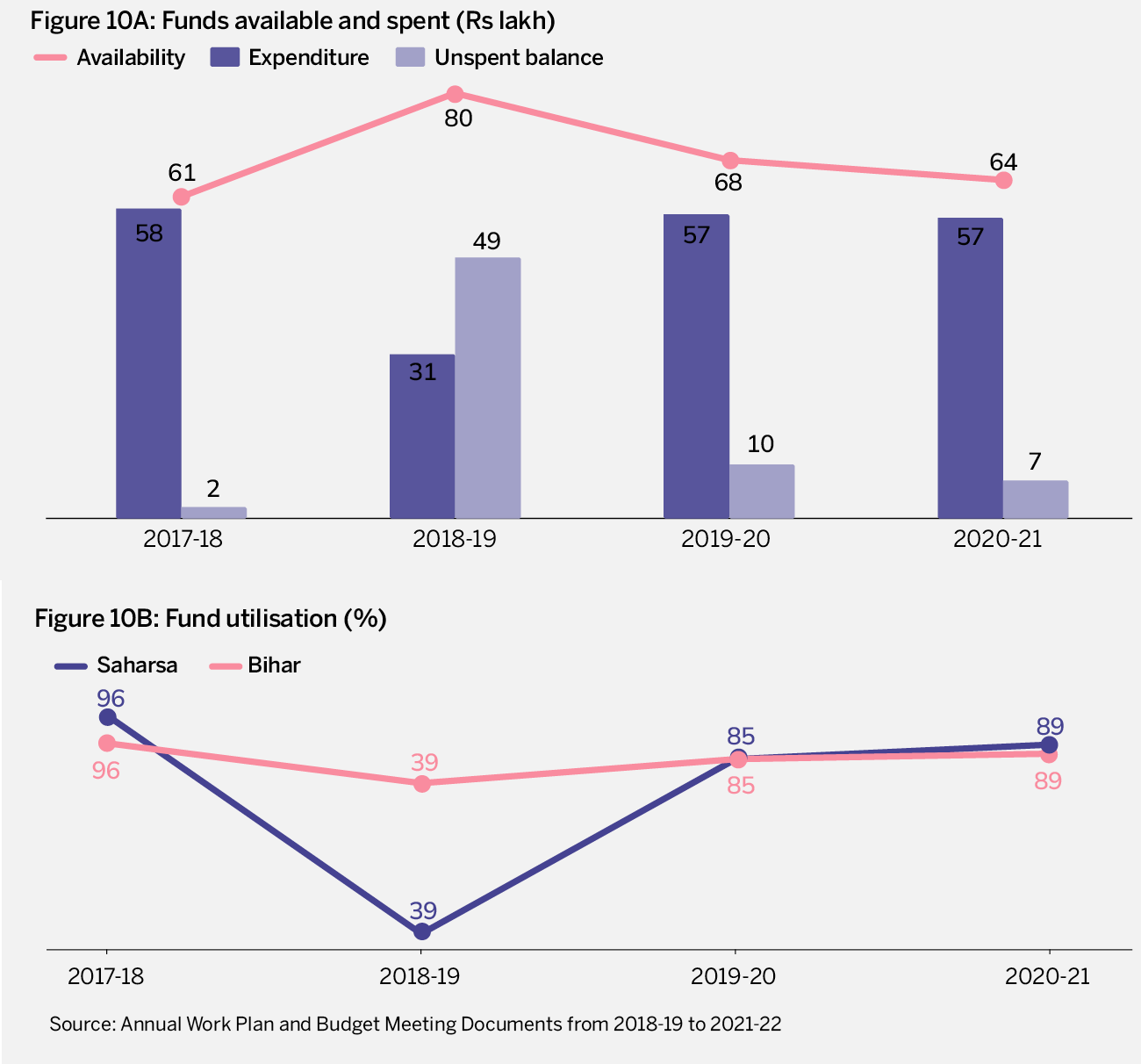

The data points /information regarding MDM have/has been taken from the Annual Work Plan and Budget Meeting Documents (AWB&PM) for the years from 2017-18 to 2020-21. These documents were accessed at https://pmposhan.education.gov.in/.

Transparency and Accountability Parameters

Availability of Information and Comprehensiveness

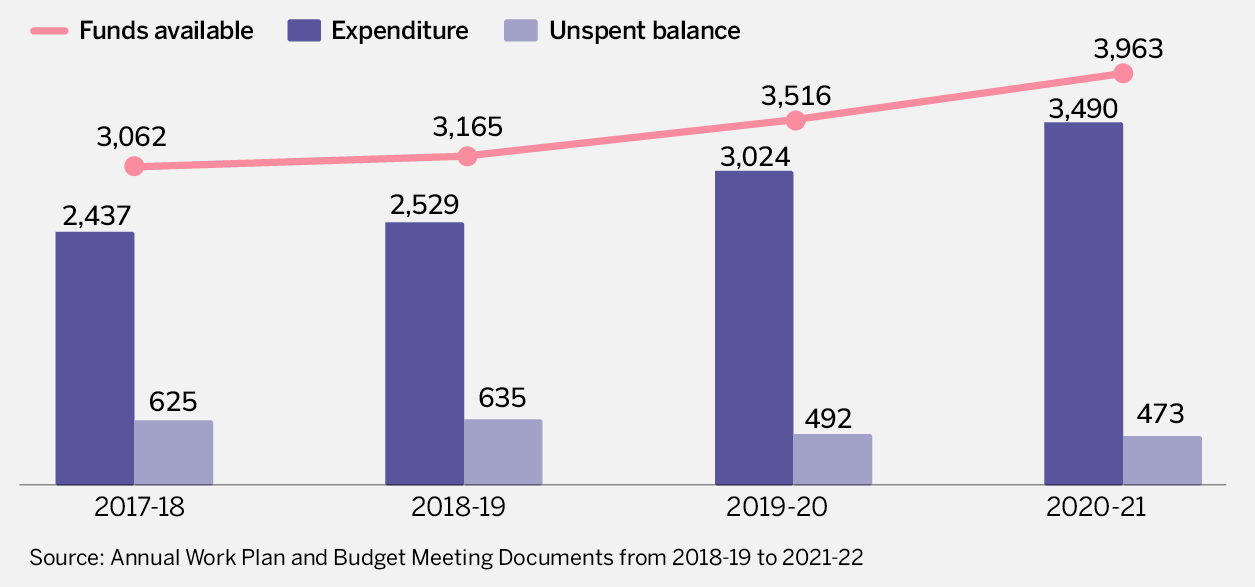

Information on funds available

Information on funds utilized

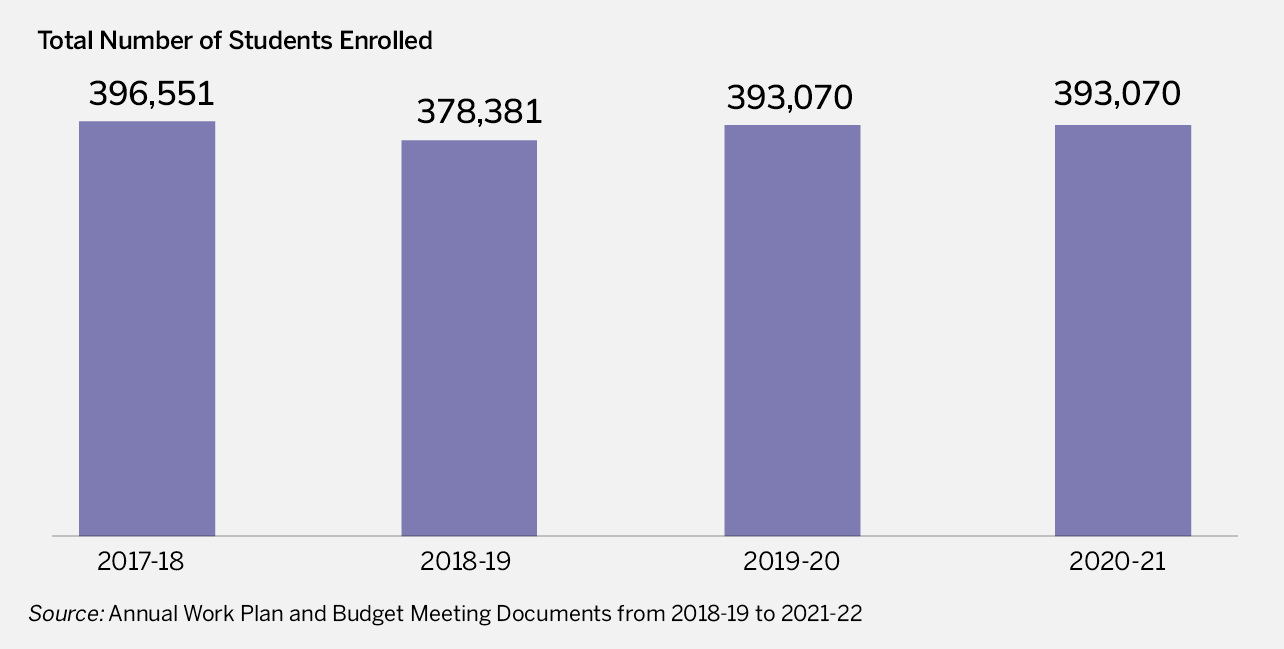

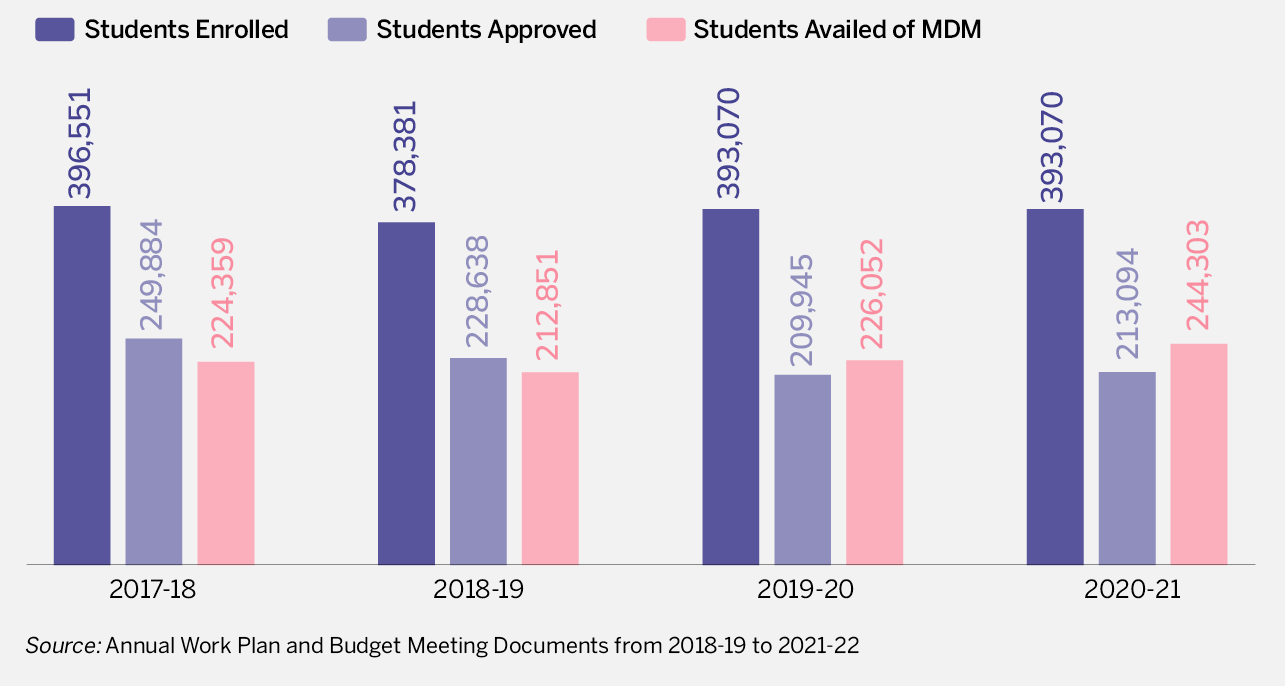

Information on number of students enrolled

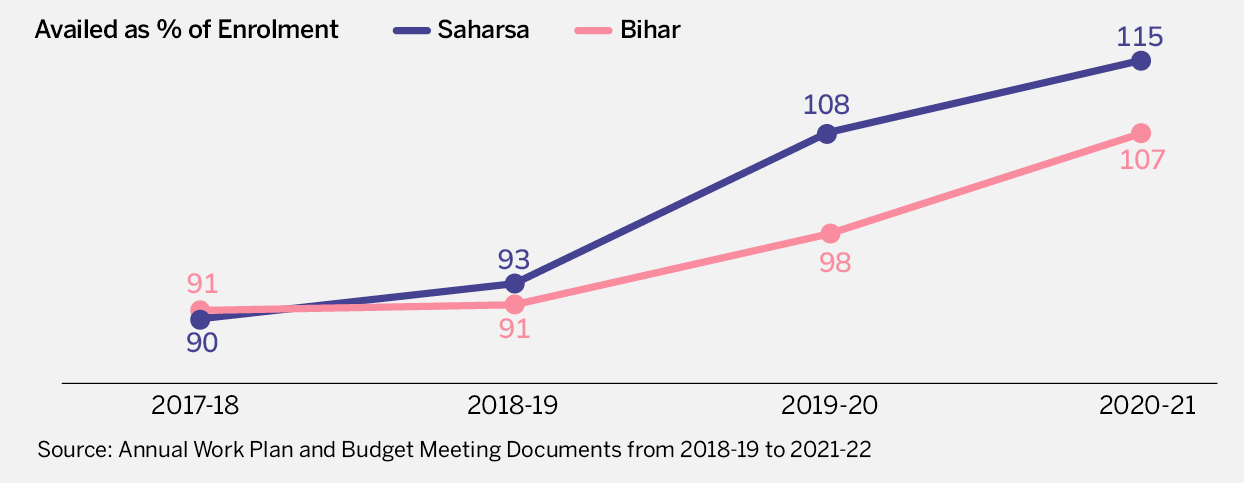

Information on number of students availing MDM

Information on number of meals served

Gender-wise disaggregation of beneficiary data

Caste-wise disaggregation of beneficiary data

Geographical Granularity of the fiscal indicator

Information on number of schools

Accessibility

Language in which information is available

Compatibility on devices

- Phone, tablet, laptop friendly

Timeliness

How frequently are data updated?

Relevance

How relevant would users find it

- The data available in the MDM website can be used by researchers, scholars and policy makers. While the information on the website is vast, further disaggregation of data based on gender can help understand the ways MDM affects education and the nutritional status of girl children.

Reliability

Are the data reliable?

- CAG audit reports are not available on the MDM website, hence authenticating the data with MIS and ground verification is essential.

Accountability and Citizen’s Participation

Social Audit schedules

- Social auditing is mandated for all districts.

- While the account for the number of schools covered, organisations/institutions conducting the audit and expenditure is available, the reports on the website are not up to date for all the states and years.

Availability of information on Grievance Redressal Mechanism for beneficiaries

- Contact details to lodge complaints are listed on the website for every state.

- Details on the number of complaints, status of complaints and action taken are also available.

- States follow different mechanisms for grievance redressal.